what is a deferred tax provision

The method for accounting is covered under. Its also a result of the differences in income recognition between income tax accounting rules and your.

Define Deferred Tax Liability Or Asset Accounting Clarified

Often the only impact is that the effective tax rate on the books.

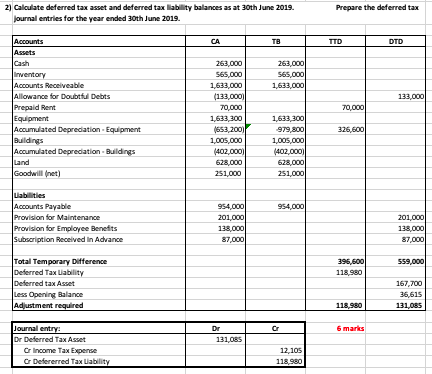

. Deferred tax arises when there is a. Add or subtract the net change in temporary. Deferred income tax expense is the opposite of deferred tax assets.

Increase the book profit by the amount of deferred tax and its provision or. What is the purpose of a tax provision. Deferred income tax expense.

A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces. Start with pretax GAAP income. Accounting for Sole Traders.

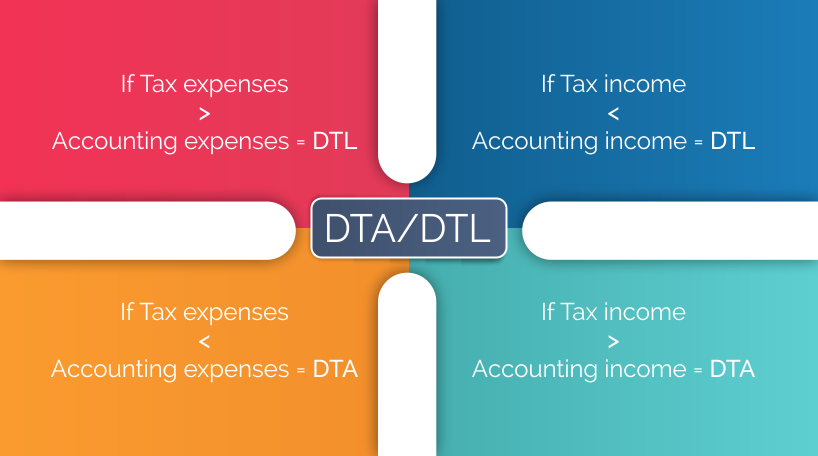

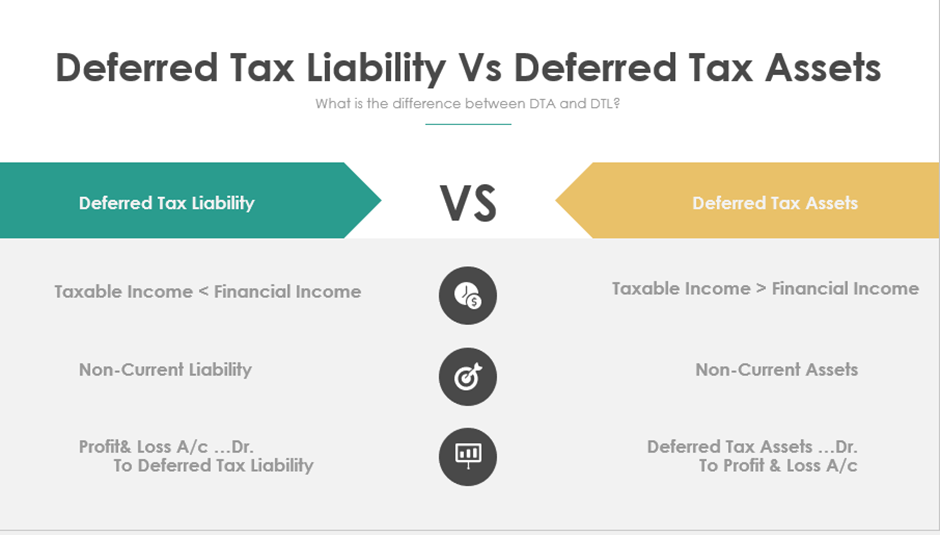

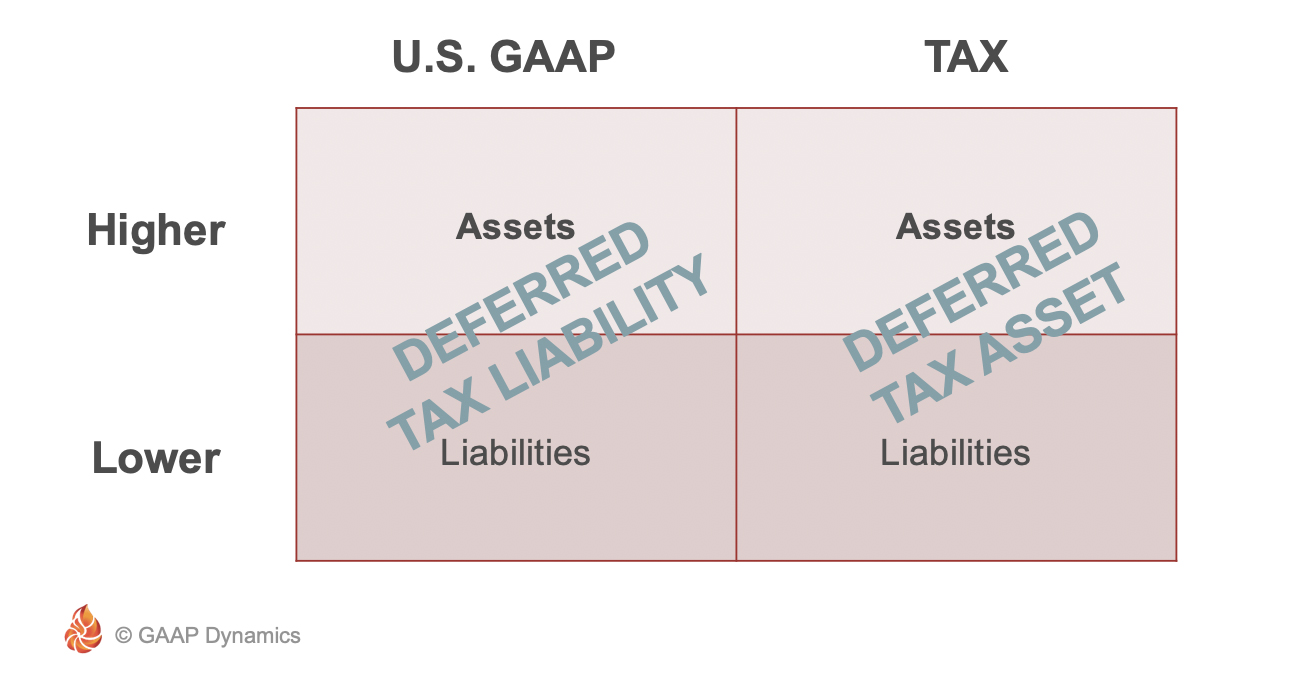

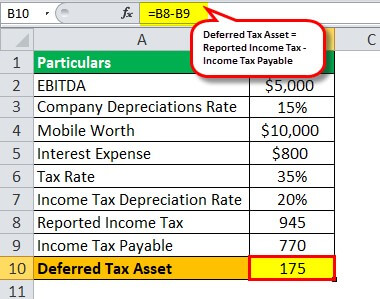

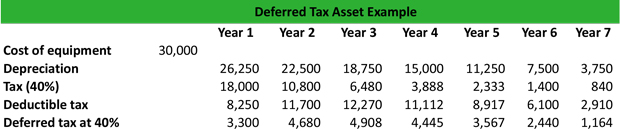

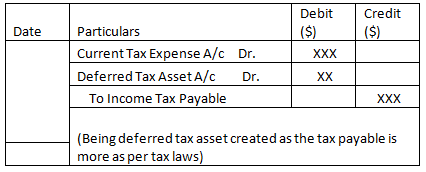

Deferred tax is the gap between income tax determined by the companys accounting methods and the tax payable determined by tax authorities. If the tax rate is 30 the Company will make a deferred tax asset journal entry Deferred Tax Asset Journal Entry The excess tax paid is known as deferred tax asset and its journal entry is. A deferred tax is recorded in the balance sheet of a company if there are chances of a reduced or increased tax liability in the future.

Decrease the book profit by the amount of deferred tax if at all such an amount appears on the. A deferred tax liability occurs when a business has a certain amount of income for an accounting period and that amount is different from the taxable amount on their tax return. The deferred tax represents the companys negative or positive amounts of.

The deferred income tax is a liability that the company has on. They gave me RSU and ESPP as Perq and deducted TDS for A. Deferred tax is the tax that is levied on a company that has either been deducted in advance or is eligible to be carried over to the succeeding financial years.

Add or subtract net permanent differences. A permanent difference will never be reversed and as such will only have an impact in the period it occurs. A provision is created when deferred tax is charged to the profit and loss account and this provision is reduced as the timing difference reduces.

The result is your companys current year tax expense for the income tax provision. However in its tax statements it. However they are important for accounting purposes.

21-22While filing ITR the SYSTEM auto considered. To estimate the current income tax provision. This guide will help you to gather information about corporate tax provisions tax implications and relevant facts.

A deferred provision assigns revenue earned and expense paid to applicable time periods irrespective of when money was actually received or the expense actually paid. Deferred taxes are not recognised under the Income Tax Act 1961. Answer 1 of 2.

Deferred tax is a balance sheet line item recorded because the Company owes or pays more tax to the authorities. Lets look at an example. For instance at tax rate of 30 percent a deferred tax liability or benefit for a 2100 would generate a deferred tax of 30100 x 2100 630.

Deferred tax is the tax effect of timing differences. It is important to recognize deferred tax. What is a tax provision.

Net Operating Losses Deferred Tax Assets Tutorial

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

2022 Cfa Level I Exam Cfa Study Preparation

Deferred Tax Liabilities How Is It Treated In Accounts Wall Street Oasis

When A Tax Cut Is A Profit Hit Journal Of Accountancy

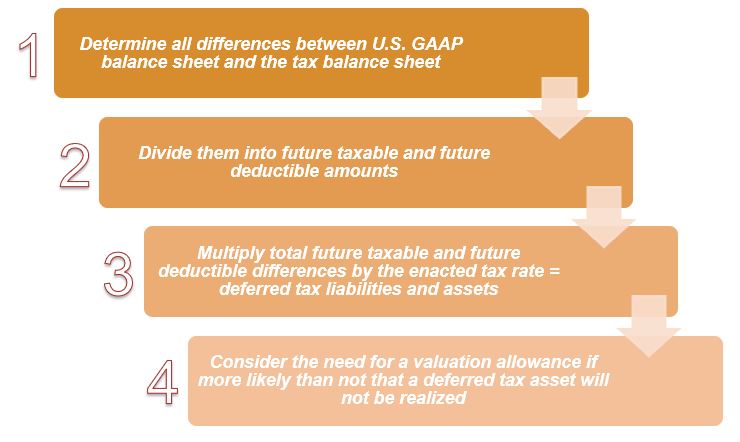

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Deferred Tax Meaning Expense Examples Calculation

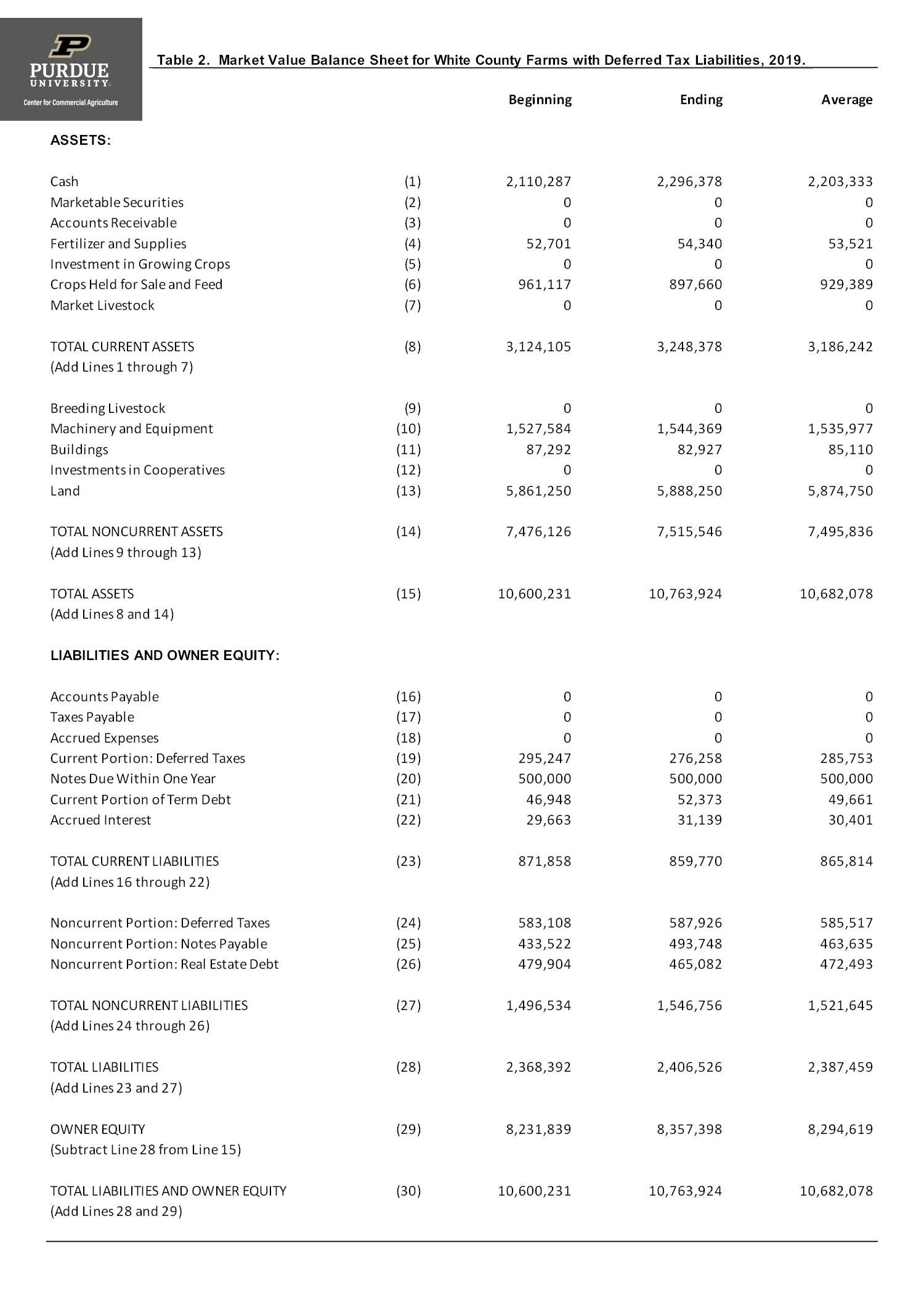

Computation Of Deferred Tax Liabilities Center For Commercial Agriculture

Solved 4 020 000 1 Calculate The Taxable Income Tax Loss Chegg Com

What Is A Deferred Tax Asset Definition Meaning Example

Training Modular Financial Modeling Ii Corporate Taxation Detailed Modeling Deferred Tax Assets Modano

Solved On January 1 2019 Bourbon Company Reported A Deferred Tax Course Hero

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Asset How To Create Deferred Tax Assets With Example

Deferred Tax Asset Deferred Tax Liability Basic Understanding Tax Vs Financial Accounting Youtube